Celebrating our Client's Successes

Success Stories

Simplifying the liquid fuel payment guarantee process.

-

Available Cash Payment Guaranteed.

-

Insurance Guarantees.

-

Fuel Finance / Facility.

-

Empowering and assisting the establishment of new entrants.

-

Improving the processes for existing / established industry participants.

Simplifying the liquid fuel payment guarantee process.

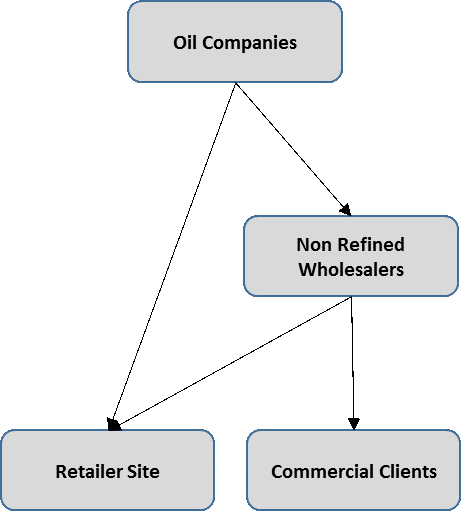

Through G-PAY™ we have been involved in the Liquid Fuels Industry since 2011 and on a high level we understand the industry to be divided into several tiers/levels for distribution and sales. These start with the Oil Companies and Refineries (The Majors) who provide and sell to lower tiers/levels. These being direct to Oil Company owned/branded Retailer sites, Non-Oil Company owned (White) sites and also to Non-Refining Wholesalers (NRW’s) who make up a large volume of their sales. The Majors also in some instances sell product directly to some of the larger Commercial Clients.

NRW’s in return service their own client base which could consist of Retail Sites but mainly Commercial Clients who purchase in Bulk.

Product is mainly held in storage by The Majors although some NRW’s may have their own smaller storage facilities. These facilities are often used for the sales of smaller quantities to the NRW customers. The product is generally sold on a Client Own Collection (COC) or a Delivered by The Major or NRW basis. COC refers to the process whereby a client would collect product from The Major or NRW while the delivered portion is done by The Major or NRW as may be applicable. COC and Delivered is also a term used in the pricing structures provided by The Major or NRM as these models attract different pricing schedules.

Industry Challenges.

The industry is experiencing challenges on several levels, The Majors mainly provide product and do not really experience the same challenges as would be the case for NRW’s / Retailer / Commercial Clients.

Distinctions also need to be made between the established NRW’s, new entrants in the NRW level and the challenges that reflect the Retailers and Commercial Clients situations.

The NRW (Existing) – NRW’s and/or their clients currently have bank guarantees and other forms of security pledged to The Major to secure a supply of product. Majors will generally only provide product to its customers within the boundaries of these guarantees and securities. When these are depleted the Retailer and or NRW can only continue purchasing on a cash upfront basis and we understand cash flow to be the largest challenge for these entities.

The reality is that the guarantees and security provided are not regularly maintained and or adjusted by the financial institution during the course of the relationship as the fluctuation in the fuel price is affected which has a direct influence on the client and NRW cash flow position. An increase in the fuel price means that the Client / NRW measured against a fixed guarantee which means they can purchase less for their allocated value, while a decrease in the fuel price will provide the opposite. History has however shown the fuel price has mostly increased, occasionally decreases occur but never below the general growth norms. This tendency affects new Clients and NRW entrants to the market even more than it does the more established Clients and NRW’s.

The general rule with The Majors is also that no product is released until paid for in full whether it be under the guarantee / security option or as a cash customer. This rule in general provides the largest single challenge to the industry especially out of guarantee / security transactions but more specifically for the cash customers.

In the instruments developed through the G-PAY™ solution offerings there is also opportunity to establish a “clean invoicing” model as the G-PAY™ technology offers the ability to lock funds which can be guaranteed from client, to NRW all the way through to the Majors for settlement of the actual collected or delivered quantities.

These NRW and Client challenges offer the opportunity for the implementation and deployment of the G-PAY™ instruments and solutions.

The NRW (New Entrant) – For these entities the challenge above is even more overwhelming. These entities normally do not have a proven track record, financial track record to obtain guarantees from financial institutions, and do not have the financial backing or the ability to pre purchase product. The Majors policy “Payment Before Collection” of the product also does not favor their position.

Clients are very reluctant to pay the NRW before they have received their product. This leaves the new entrant NRW in a position where his/her business is not going anywhere. The Department of Energy has issued an unknown number of NRW licenses in the past 5 years but only a handful have managed to do “some” business but they are not managing to retain these clients as they are not able to offer competitive solutions to customers.

These New NRW challenges offer the opportunity for the implementation and deployment of the G-PAY™ instruments and solutions.

The Clients – Most clients are accustomed to having to pay upfront for product at the moment but the demand for extended payment terms is increasing. The Majors and the NRW’s are however not always in a position to provide terms to these clients.

These client challenges offer the opportunity for the implementation and deployment of the G-PAY™ instruments and solutions.

Industry Solutions.

The solutions through G-PAY™ are configurable and may be applied differently on a case by case basis depending on the level of deployment, the client profile, risk and control to be asserted on the control over the funding and the unique G-PAY™ ability to verify the availability of funds in the account on creation of the order, the ability to then reserve the funds against the Selling entity, the ability to lock the funds upon acceptance of the order by the selling entity, and thereafter to guarantee the payment to the selling entity. In this solution G-PAY™ further offers the ability to on/after delivery reconcile the order payment to the actual delivered/collected quantities, eliminating the issue of over/under deliveries/collections which enables clean invoicing based on only the confirmed order quantity value being processed from the buyer to the seller account. This functionality is supported by the G-PAY™ host integration with the banks.

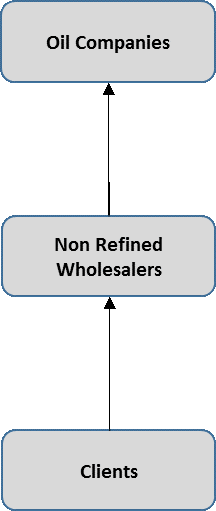

Referring to the tiers mentioned earlier (The Majors, The NRW and The Clients) G-PAY™ further offers the ability to settle all three ties in the same transaction from funds held in the lowest tier, the client. This includes the pricing structures that have been defined between the parties for the various levels.

The above in its simplest format defines the capabilities, functionality and the G-PAY™ ability to offer a new and unique way of guaranteeing payments and providing an electronic/digital guarantee for processing through G-PAY™.

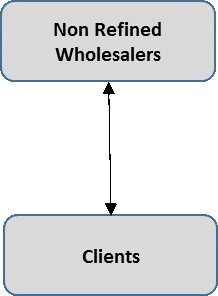

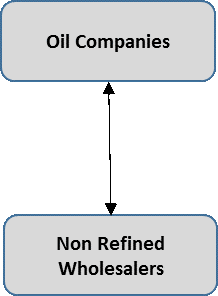

Two Tier Models – Where funds reside at the lower lever, G-PAY™ will first verify the availability of funds in the buyer account, reserve and lock the funds allowing the delivery or collection to take place after which the actual delivered/collected quantities will be confirmed. Only after confirmation of the delivered quantities will the funds be processed from the buyer to the seller. This model therefore caters for transactions between clients and NRW’s or between NRW’s and The Majors.

Three Tier Models – In a three-tier model configuration, the G-PAY™ system, assuming that the funds reside with the client, will settle both the top tiers on completion of the delivery or collection of the order. By means of an example pricing structure, with the client price with the NRW being R10.00, and the NRW price with the Oil Company being R8.00, the G-PAY™ system will automatically calculate and process as follows:

- The system will process R10.00 from the Client to the NRW. Immediately process R8.00 to the Oil Company leaving R2.00 in the NRW account. Where fees have been set, the system will also process these fees from the client to the appropriate party.

- Variations on the above models – Where authorization for every transaction is required, we can implement the standard G-PAY™ software which can be configured to workflow a transaction to the appropriate party for authorization before processing on either of the levels.

- Although the standard G-PAY™ Solution and functionality, based on available cash in the clients account, already suggests a solution to the Liquid Fuels industry, we have also developed Financing Solutions, Insurance Guarantees and other instruments to offer to the industry.

In Summary.

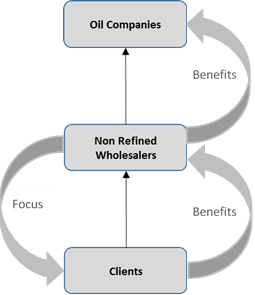

Traditionally the focus from Financial Institutions and The Majors have been on the capability and the credit and risk profile of the NRW and its ability to provide Security, Guarantees and other similar instruments to achieve an allocation or product from the Majors. The G-PAY™ Solutions have created the ability to shift such focus from the NRW to the NRW Clients.

With the focus now being on the NRW Clients and not the NRW being evaluated for such facility, the risk is not only mitigated for the Financial Institutions, but it also enables New NRW entrants to start a business and it offers existing NRW’s the capability to expand their business (product volumes). In fact, the NRW business size is no longer dictated or restricted by the Security, Guarantees and other similar instruments provided by the NRW, but rather the NRW’s ability to sell. The benefits of such model is passed from the Client to the NRW and rolled up to the Majors.

Please contact us for more information on the G-PAY™ instruments and models available to the Liquid Fuels sector.

SME’s more fundable.

-

Keeping track of the cookies.

-

Lock-Box unlocks SME growth potential.

Keeping track of the cookies

In 2020 South Africa's media was filled with reports of fraud, corruption, and maladministration at all levels of the countrys private and public sectors. In a business environment that is increasingly sophisticated from a technology perspective, one could be forgiven for thinking that this kind of behaviour should be on the decline, This is because technology can be effectively used to address these risks. Reality does not seem to bear this out.

Limiting the misdirection of funds.

Mettle has made a significant investment in time and money into a solution provider that can assist in eliminating these kinds of nefarious activities. Established in 2011. G-PAY™, which stands for"guaranteed payment", provides patented payment technology solutions to various industries. Its solutions support the ability to configure predefined process flows to initiate and process payments and to electronically manage and control funds for specific, predetermined utilisations. G-PAY™ is an authorised payment services provider enrolled as a systems operator with the Payments Association South Africa. Its solutions provide full integration to the banking services of ABSA Bank Limited, First National Bank, a division of FirstRand Bank Limited, Standard Bank Group Limited, and Nedbank Limited.

Reducing human intervention.

G-PAY™'s Capital Solutions and Fund Management Solutions offer users the ability to manage payments such that they can only be made to pre-authorised entities for specific purposes. For example, funding provided for a property development or the acquisition of equipment can only be used for payments to suppliers of specific materials or equipment. Through its Transactional Processing Solutions, it can report on such funds as may be required by the managing entity while also offering the abil'ty to provide dashboard views, alerts and notifications.

Ensuring compliance.

Furthermore, its cloud technology solutions offer centralized access to information, although processing can be done on a decentralised basis if required. Through these solutions G-PAY™, offers its clients the ability to automate several processes, add controls and mitigate risk by reducing human intervention that can be used to ensure compliance.

It is not unreasonable to hope that the management of private and public entities will take steps to make use of solutions such as this to limit the misdirection of hard-earned funds by corrupt individuals.

-

William Marais

-

T: + 27 21 929 4884

-

e + 27 82 807 3349

- E: Wmarais@mettle.net

Mettle Lock-Box article.

Lock-Box unlocks SME growth potential..

President Cyril Ramaphosa, during his 2020 State of the Nation Address, has urged participants in the private and public sector to find sustainable solutions to combat and reduce inequality, poverty and unemployment. The public sector has committed to assist small to medium enterprises “SME's” from a procurement perspective. In addition, many private sector companies have committed to supporting SME's through their procurement processes.

The problem for SME's and suppliers

Most SME's are not in a position to pay for the goods and services that they need in order to fulfil their obligations to their customers. They therefore need to be supplied on credit, which means that any company selling to them must take on the risk of non-payment or late payment by the SME. This is because the SME’s client may fail to pay or delay payment or the money could be lost through fraud or theft on the part of the SME.

A compounding factor is that even in instances where the private sector is prepared to grant credit to the SME, the credit insurance coverage that such supplier can access to cover the probability of SME's defaulting on their obligations, is normally insufficient to cover the credit under consideration.

If these challenges persist they will limit the growth of SME's.

The ‘Lock-Box’ Technology

Mettle Specialised Finance (Pty) Ltd (Mettle) and its sister company, Incatorque (Pty) Ltd (trading as G-PAY™), have, together with SME suppliers and a well-known insurer, developed a “lock-box” bank account “the Lock-Box” that functions in a manner that addresses the risks and requirements of those involved in the SME supply process. In particular, it manages the automated flow of payments between parties in the supply chain and removes the risk of manual intervention that could cause cash to flow to unauthorised parties or accounts.

The Lock-Box is a bank account independently administered by Mettle with any of four retail banks in South Africa integrated on the G-PAY™ platform. The rules regarding the payment flows and processes that the account is managed by is recorded in the agreement between the SME, its supplier and Mettle and configured in the G-PAY™ system. The SME’s customer (the end user that is the public or private sector client of the SME) will remit the proceeds of the SME’s invoice for the supply of the goods or services into this bank account. The rules of the Lock-Box will ensure that the SME’s supplier’s invoices are settled first, whereafter the remaining balance, after fees, is released to the SME.

Example:

The operational mechanics of the Lock-Box are set out in the following example:

On 1 February 2020, Sipho Ngubani (Pty) Ltd (“SME”) obtains a tender to supply 100 laptops to the Department of Sport and Recreation (“End-Customer”), to the total value of R 1 000 000. The SME approaches Xolile Computers (Pty) Ltd (“Distributor”) to procure the supply of the 100 laptops on credit. The SME does not pass the Distributor’s credit requirements.

Either the SME or the Distributor contacts Mettle about the possible use of the Lock-Box. Mettle facilitates the conclusion by the Distributor, the SME, Mettle and G-PAY™ of an agreement that in essence records (1) the terms of supply and payment between the Distributor, the SME and the End-Customer, (2) the payment rules and recipient bank accounts of the Distributor and the SME, which will be programmed into the Lock-Box, (3) the terms of the service that G-PAY™ will provide, and (4) the bank charges and fees payable to Mettle and G-PAY™ for the use of the Lock-Box.

Once the agreement has been completed Mettle will open the Lock-Box and confirm with the Distributor and the SME the amount that will be paid for the supply of the 100 laptops, say, R 800 000.

The Distributors delivers the laptops and the SME renders the invoice to the End-Customer.

On 28 February 2020, the End-Customer effects payment of the R 1 000 000 into the Lock-Box, assuming 30-day credit terms were agreed between the SME and the End-Customer. Mettle oversees the settlement of the following payments by the G-PAY™ platform as follows:

- 1. Firstly, to the Distributor (based on the bank account information provided): R 800 000;

- 2. Secondly, to the SME (based on the bank account information provided): The balance less the agreed bank costs and fees; and

- 3. Lastly, the fees due to G-PAY™ and Mettle.

Thereafter, Mettle will confirm receipt of payment with the Distributor (the G-PAY™ portal will have sent the Distributor an automated confirmation as well) and once receipt has been confirmed, Mettle will confirm receipt by the SME of its margin and the computation thereof. Thereafter the transaction is closed.

Risk management:

Risks are present when managing the flow of any payments. The Lock-Box has been designed to mitigate the risks in the manner set out in Table 1. It should however be noted that the Lock-Box is not a guarantee and cannot address the risk of the End-Customer not honouring its obligation to pay the SME at all or on time.

| No. | Type of Risk | Risk Definition | Illustration | Risk Mitigation |

|---|---|---|---|---|

| 1 | Credit Risk | Risk of default if the End-Consumer makes its payment directly into the SME's account. | IF payment is received directly into the SME's bank account, the SME may use the proceeds for other matters and not pay the Distributor. | The Lock-Box will prevent the SME from accessing the proceeds of the End-Consumer's payment until it is entitled thereto as Mettle and G-PAY™ will administer the funds independantly of both the SME and the Distributor. |

| 2 | Performance Risk | Risk that goods and/or service may fail to perform as required or as agreed between the SME and the Distributor. | Distributor must ensure that they are involved in the delivery process of the goods and/or services, in order to prevent late or non-payment by the end End-Consumer. | Distributors should be involved in the delivery proccess and obtain the ptoof proof of delivery from the End-Consumer. In addition, Distributors should remain in contact with the finance department of the End-Consumer in order to assist the SME to respond timely to any issues that may arise. |

| 3 | Insolvency Risk | Risk that the SME will not be able to meet its debt obligations, in the event of insolvency occurring. | The SME goes insolvent before the proceeds are received. | The Lock-Box account does preferably not belong to the SME. In the event of the SME being liquidated all the liquidator will legally be entitled to, is to the receipt of the SME's margin on the transaction. In addition the use of the Lock-Box may enable Distributors to take credit insurance out in respect of SME's that it would not have been able to cover without it. Mettle can also assist Distributors with the structuring of additional security if required. |

Both the public and private sectors will need to stop having conversations about what is wrong or making observations in broad terms about what is needed to build our economy. Every challenge has a solution but it will take a different kind of insight to unlock South Africa’s potential.

Mettle Corporate & Specialised Finance

Modernising futures contracts for the fuel industry

-

Facilitating the hedging of diesel futures contracts.

-

Physical contract execution.

-

Contract settlement.

The JSE Diesel contract is a global first for commodity derivative contracts, finding a balance between physical and cash settlement. Position holders at expiry of the futures contract are cash settled based on a JSE published settlement value. Clients authorized and interested in physical delivery can use the spot basis functionality to facilitate physical deliveries.

This Diesel hedge contract reflects the South African 50ppm Diesel wholesale price more accurately. By using data resulting from the physical deliveries, the JSE contract enables price convergence of the futures price and the spot market price.

G-PAY™ contributes in this solution by offering the technology to enable the physical execution and the settlements of diesel in completion of futures obligations.

Solving the payment challenges of allocating funds to a 3rd party in Agriculture

-

Facilitating variable funding models. (reallocation of bank facility).

-

Enabling extended payment terms.

-

Automated sweeping / settlements for extended payment terms.

-

Emerging & Established farmer empowerment configuration models.

Under construction

Protecting investor funds

-

Enabling cash management disciplines.

-

Closed loop procure to pay models.

-

Closed loop beneficiary payment models.

-

Cashflow Waterfall solutions.

-

Transactional mapping and reporting.

Under construction

e-Escrow

-

Enabling financial institutions to digitise traditional Escrow models.

-

Enabling financial institutions to automate traditional Escrow processes.

-

Enabling closed loop or open loop Escrow solutions.

-

Enabling procure to pay solutions in e-Escrow.

-

Comprehensive e-Escrow functionality.